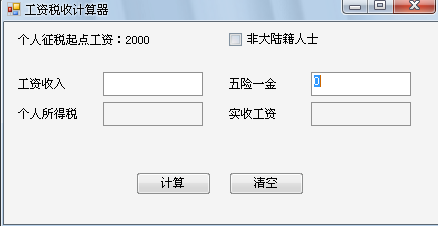

个人所得税计算器

本文共 2914 字,大约阅读时间需要 9 分钟。

今天心血来潮,编写了一个个人所得税计算器,呵呵,虽然功能不是很强,而且也是重复造轮子(网上也有许多的个人所得税计算器),不过“纸上得来总觉浅,绝知此事要躬行”,自己动动手绝对有好处的。  下面是个人所得税计算的类:

下面是个人所得税计算的类:

下面是个人所得税计算的类:

下面是个人所得税计算的类: 1namespace SalaryComputer 2{ public class PersonalIncomeTax { 字段/属性#region 字段/属性 /** /// 税率 /// private double[] taxRate = { 0, 0.05, 0.10, 0.15, 0.20, 0.25, 0.30, 0.35, 0.40, 0.45 }; 11 /** /// 税率(税率最好保存在数据库表里或xml文件,当国家出台新的个人所得税政策法规时,不需要修改代码部分) /// public double[] TaxRate { get { return taxRate; } set { taxRate = value; } } 20 /** /// 速算扣除数 /// private double[] subtractNumber = { 0, 0, 25, 125, 375, 1375, 3375, 6375, 10375, 15375 }; 25 /** /// 速算扣除数 /// public double[] SubtractNumber { get { return subtractNumber; } set { subtractNumber = value; } } 34 /** /// 超过起征税的数额 /// private double[] surpassAmount = { 0, 500, 2000, 5000, 20000, 40000, 60000, 80000, 100000 }; 39 /** /// 超过起征税的数额 /// public double[] SurpassAmount { get { return surpassAmount; } set { surpassAmount = value; } } 48 /** /// 征税起点工资 /// private double startTaxSalary; 53 /** /// 征税起点工资 /// public double StartTaxSalary { get { return startTaxSalary; } set { startTaxSalary = value; } } #endregion 63 构造函数#region 构造函数 /** /// 无参构造函数 /// public PersonalIncomeTax() { StartTaxSalary = 2000; } 72 /** /// 征税基本工资有时会随国家政策,法律变更 /// /// 征税基本工资 public PersonalIncomeTax(double taxSalary) { StartTaxSalary = taxSalary; } #endregion 82 自定义方法#region 自定义方法 /** /// 计算个人所得税,返回应缴税收,征税后所得薪水 /// /// 薪水 /// 五险一金数额 /// 是否是中国国籍 /// 税后所得实际工作 /// 返回个人所得税 public double CalculatePersonTax(double Salary, double Welfare, bool IsChinaNationality, out double taxedSalary) { double RateSalary = 0; 95 RateSalary = Salary - StartTaxSalary - Welfare; 97 if (!IsChinaNationality) { RateSalary = RateSalary - 3000; }102 int rateIndex = 0;104 if (RateSalary >= 0) { for (int index = 0; index < SurpassAmount.Length; index++) { if (RateSalary >= SurpassAmount[index] && RateSalary <= SurpassAmount[index + 1]) { rateIndex = index + 1; break; } } }116 double rate = RateSalary * TaxRate[rateIndex] - SubtractNumber[rateIndex]; taxedSalary = Salary - Welfare - rate;119 return rate; }122 #endregion }124}125 转载地址:http://zluml.baihongyu.com/

你可能感兴趣的文章

说说网络通信模型

查看>>

SQLite第二课 源码下载编译

查看>>

ibatis动态生成列时的列名无效

查看>>

通用汽车新增130辆测试无人车,配激光雷达

查看>>

python之通过“反射”实现不同的url指向不同函数进行处理(反射应用一)

查看>>

10.6 监控io性能;10.7 free;10.8 ps;10.9 查看网络状态;10.10 抓包

查看>>

delegate的用法

查看>>

Ubuntu <2TB sdb preseed示例

查看>>

Android开发之旅:组件生命周期(二)

查看>>

使用LVS+NAT搭建集群实现负载均衡

查看>>

LVM 磁盘分区扩容

查看>>

mysql5.6之key_buffer_size优化设置

查看>>

查看Linux服务器网卡流量小脚本shell和Python各一例

查看>>

Linux TC的ifb原理以及ingress流控

查看>>

AgileEAS.NET之敏捷并行开发方法

查看>>

Java源码分析系列之ArrayList读后感

查看>>

性能测试之手机号码python生成方式

查看>>

统计数据库大小的方法

查看>>

PHP递归遍历文件夹

查看>>

用户系列之五:用户SID查看之终结版

查看>>